Testimony in trial over 2023 Jackson County Assessment wraps

KANSAS CITY, Mo. (KCTV) - After three days, testimony in the bench trial over the 2023 Jackson County tax assessment has ended.

A circuit court judge will decide if the State Tax Commission’s order limiting increases in assessed values in the assessment to 15 percent is legal.

State law requires a physical inspection if the assessed value goes up more than 15 percent.

Larry Jones, who works for the State Tax Commission overseeing the department that provides assistance to counties, testified on Thursday that 75 percent of the residential properties in Jackson County increased at or above that level.

He testified that he looked at the numbers and that physical inspections on all those properties, “It’s physically impossible to do.”

The county also claims the STC violated the state’s Sunshine law by not notifying them that the assessment was being discussed at meetings.

In closing arguments, an attorney from the county said that the county was never invited to commission meetings in violation of the law.

He went on to say that the tax commission should have been supervising the county more closely.

The state, in closing arguments, said that the county assessors knew they were breaking the law, but “They just didn’t care.”

The tax commission heard from countless taxpayers, and even Jackson County legislators about the troubled assessment.

One taxpayer attended the court proceeding all three days.

The assessment on her home went from $341,000 in 2021, to over $900,000 in 2023.

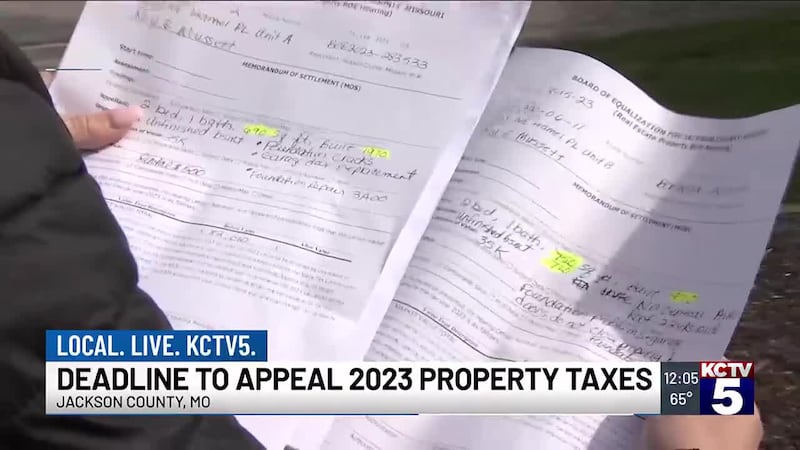

After an unsuccessful informal hearing, the homeowner appealed to the Board of Equalization and the State Tax Commission. Those appeals are on hold while the litigation plays out.

“My hope in coming to court was to get information,” said Anna Buser. “I want to know what’s happening with my appeal.”

Buser says her mortgage doubled to cover the tax.

The commission has said it had a responsibility to issue the order after hearing from taxpayers, watching media reports, getting a request from legislators, and hearing from a data expert and former hearing officer about problems with the assessment

A decision from the judge could be weeks away.

Copyright 2025 KCTV. All rights reserved.